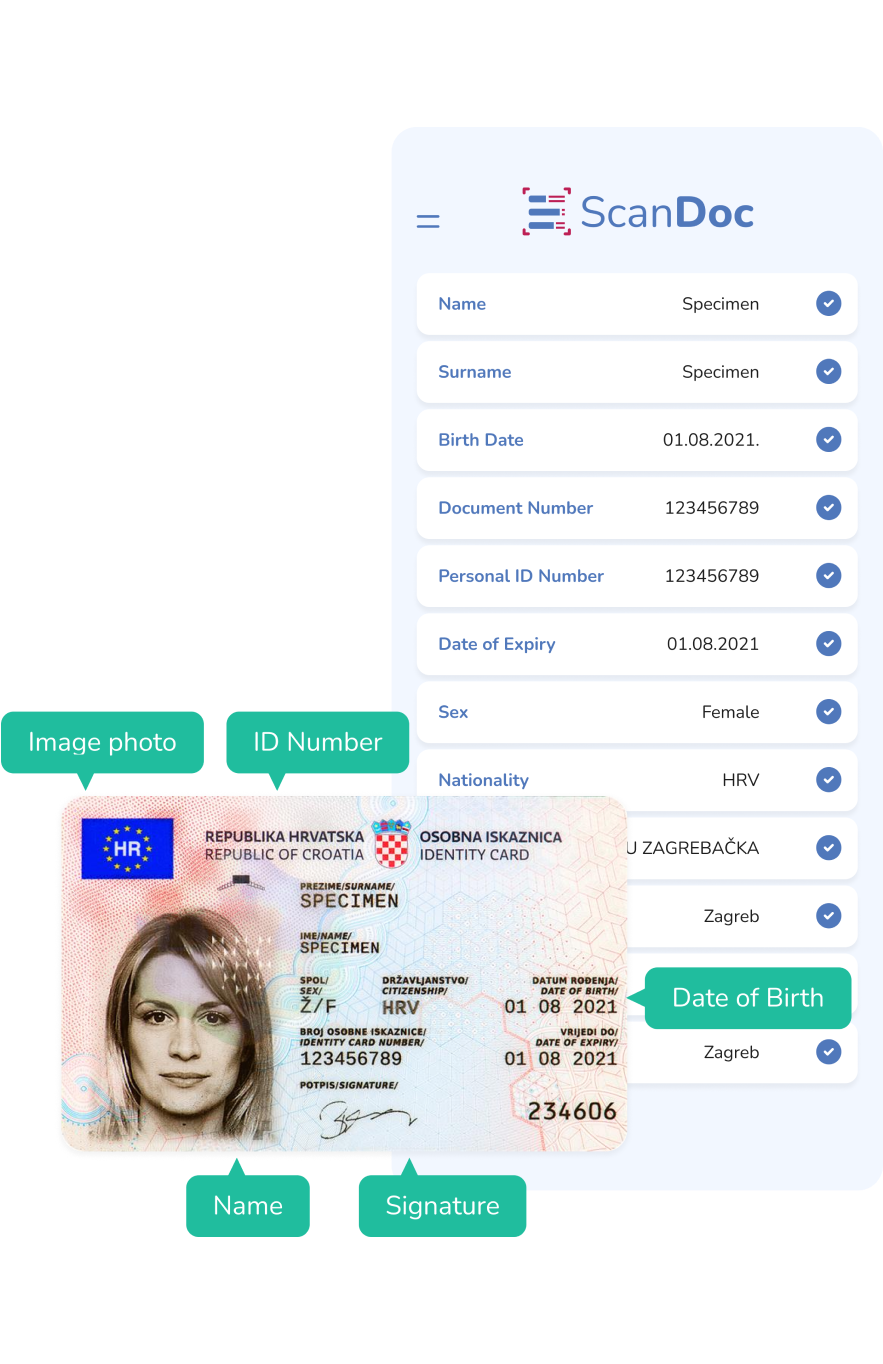

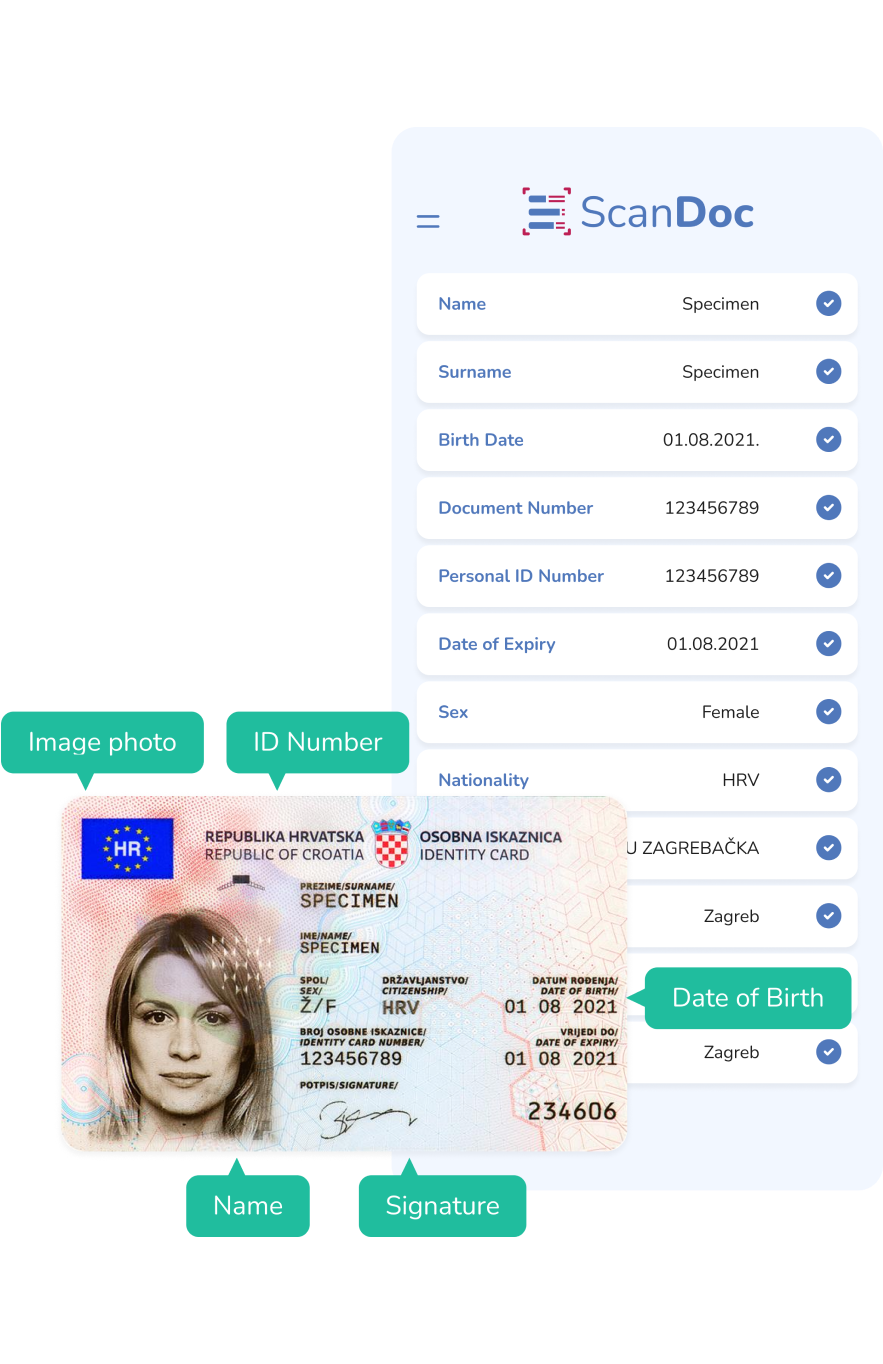

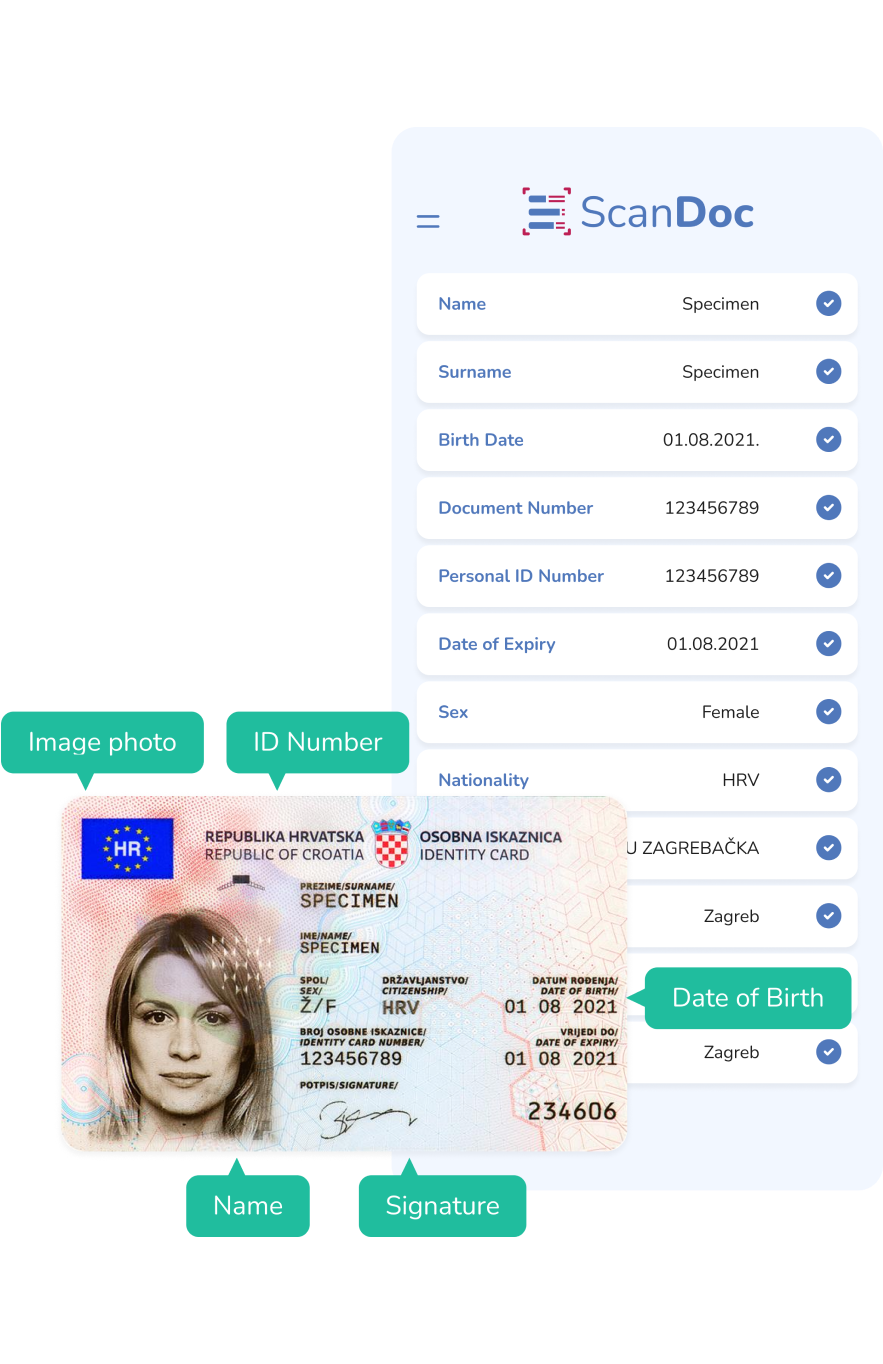

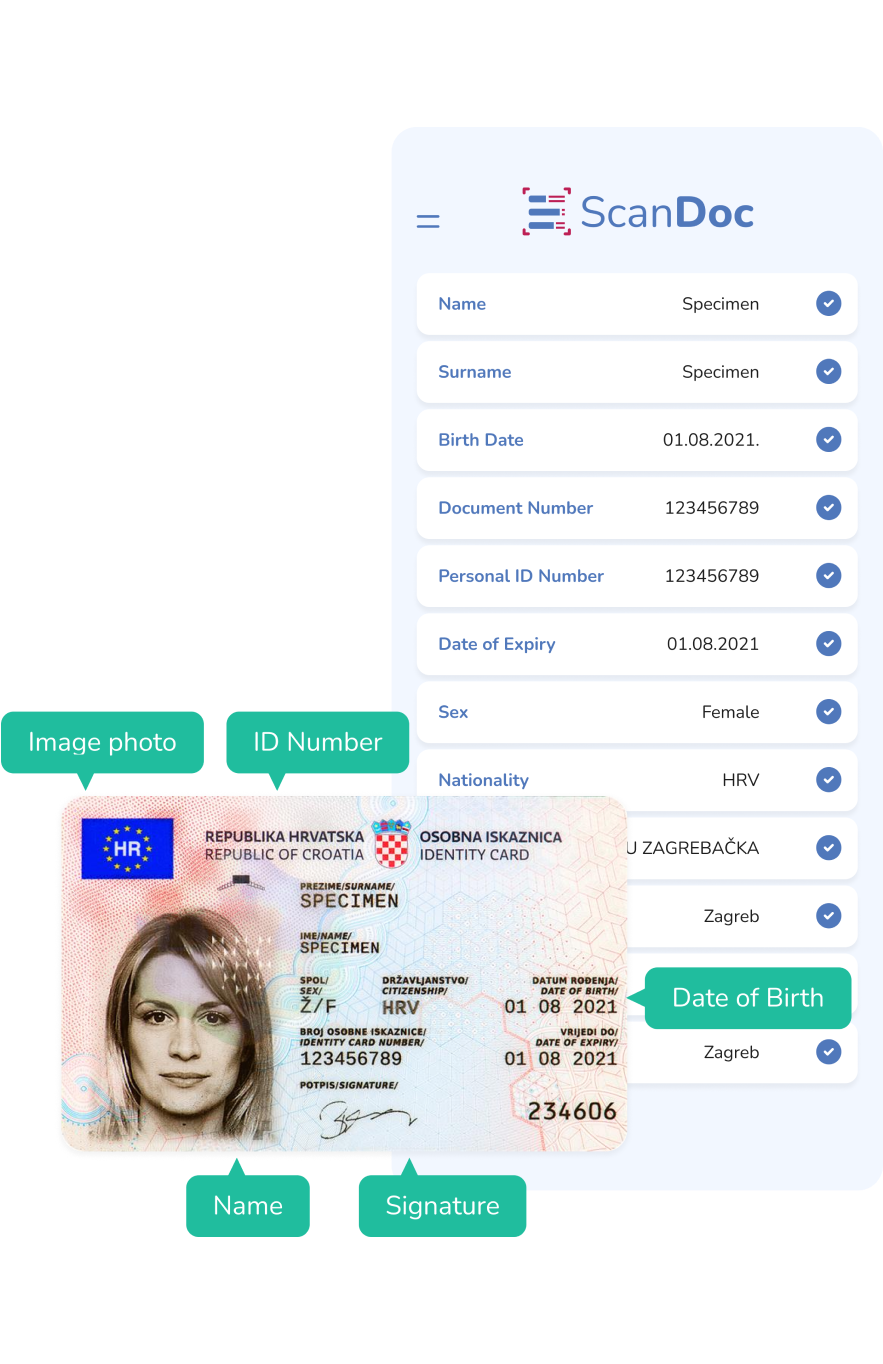

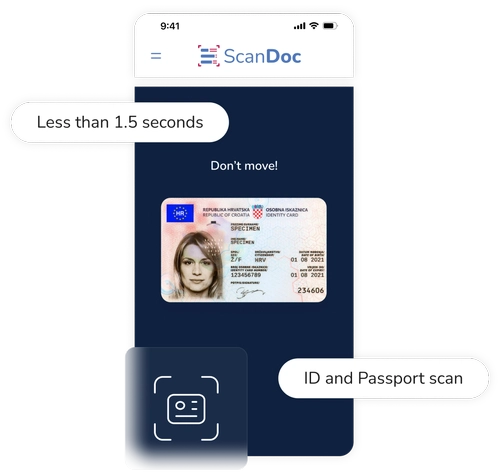

Capture or upload a clear photo of the ID or passport, making sure the entire document is visible, in focus, and fully within the frame.

ScanDoc automatically identifies and processes over 1,000 types of documents, recognizing their unique structure and content with high accuracy.

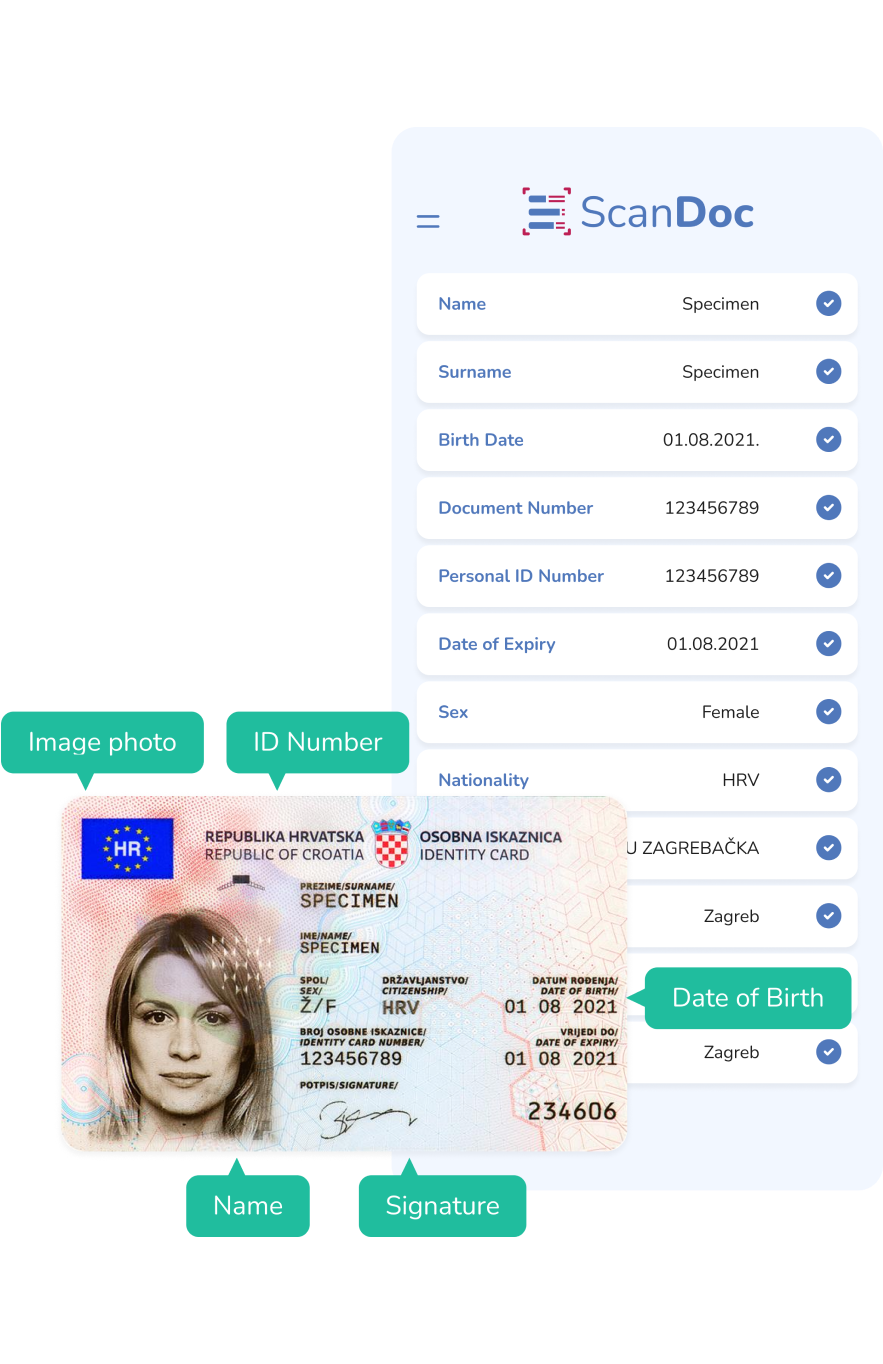

ScanDoc eliminates manual data entry by automatically extracting all relevant personal information from the document, such as name, address, date of birth, and ID number, etc.

ScanDoc cross-validates extracted data by leveraging multiple sources, including OCR (Optical Character Recognition) and MRZ (Machine Readable Zone), to ensure the accuracy.

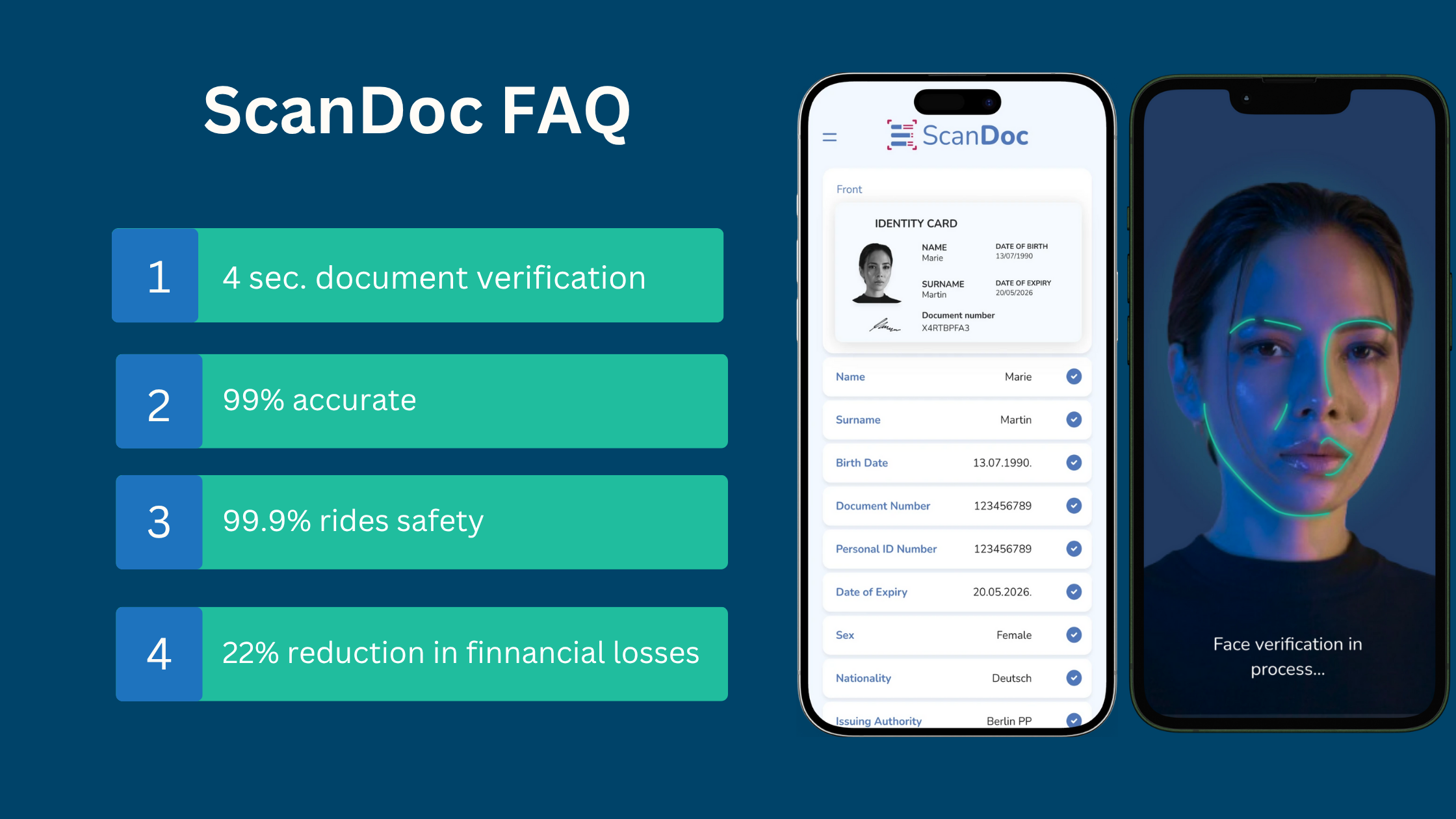

ScanDoc provides data output with 99% accuracy.

With ScanDoc, you can process more customers in less time, reducing waiting times and boosting efficiency. Whether you're in retail, healthcare, or another industry, ScanDoc’s real-time ID validation ensures a great UX for both customers and staff.

Expand globally with ScanDoc. Effortlessly process IDs from customers worldwide, overcoming language, alphabet, and time zone barriers for accurate data extraction.

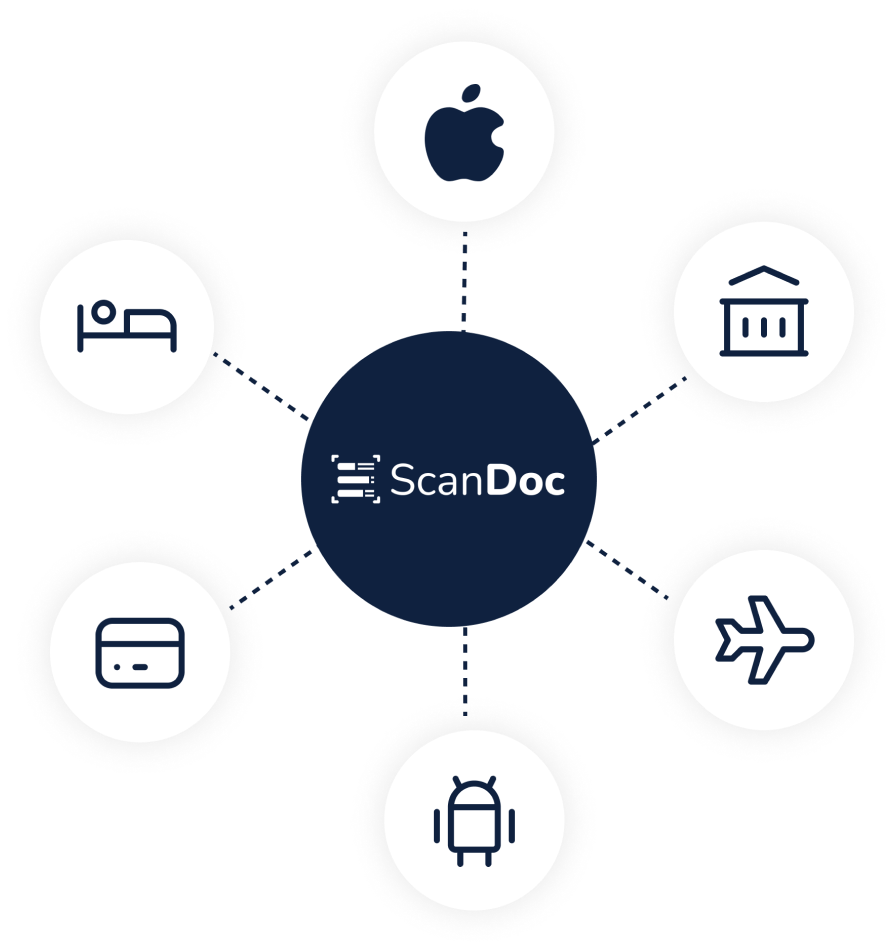

Implement document scanning solution easily with ScanDoc’s SDK, improving your existing mobile apps, systems, and platforms without extensive development or high costs.

Speed up online and reception hotel check-in.

Connect ScanDoc with the hotel property management system.

Manage purchases for age-restricted products and services.

Integrate age verification with ScanDoc to prevent minors from purchasing products and services.

Simplify the car rental process with ScanDoc by scanning customers' driver’s licenses to quickly extract the necessary information. This allows you to verify their driving eligibility in real time, ensuring a smoother and faster rental experience.

Avoid any unauthorized personnel on the staff team.

Introduce ID scanning to your event staff authorization process.

ScanDoc is already implemented in hotels, financial institutions, airlines, and other businesses. Explore how your organization can enhance efficiency, reduce errors, and improve security with automated document scanning.

Request a Demo ScanDoc: The Leading Bank Card Scanning Solution for Businesses

ScanDoc: The Leading Bank Card Scanning Solution for Businesses

In today’s fast-paced business environment, manual data entry of payment card information remains one of the most significant bottlenecks in financial operations. ScanDoc offers a comprehensive bank card scanning solution that reduces processing time by up to 80% while maintaining exceptional accuracy. This technology eliminates the tedious and error-prone process of manually entering card details, allowing businesses to process transactions more efficiently and provide better customer experiences. Whether you’re a financial institution, retail business, or service provider that handles card payments, ScanDoc’s technology can dramatically improve your payment processing workflow. This article explores how ScanDoc’s card scanning capabilities work, the specific benefits they provide, and how they can be integrated into your existing systems. https://www.youtube.com/watch?v=VQXEVIQYAQU Understanding ScanDoc Card Scanning Features and Capabilities ScanDoc utilizes cutting-edge technology to capture and process card information instantly. The ScanDoc card scanning process takes less than two seconds from capture to data extraction, making it significantly faster than manual entry methods. The system works by using a combination of advanced optical character recognition (OCR) and artificial intelligence to identify and extract data from payment cards. The solution can capture all visible information on payment cards, including: Credit card numbers (PAN - Primary Account Number) Cardholder name Expiration date IBAN (International Bank Account Number), when present on the card Card issuer information Card type (debit, credit, etc.) What sets ScanDoc apart is its ability to accurately read this information regardless of card design, orientation, or lighting conditions. The credit card scanning technology can extract data from cards in any condition or orientation, making it extremely user-friendly and versatile. How OCR Technology for Payments Powers ScanDoc’s Scanning Capabilities At the core of ScanDoc’s solution is advanced OCR technology for payments that converts visual card information into machine-readable text. Unlike basic OCR systems, ScanDoc employs specialized algorithms specifically designed for financial documents and payment cards. The technology works through a multi-step process: Image capture: The system captures a high-quality image of the payment card Image preprocessing: Automatic adjustments for lighting, angle, and clarity Text detection: Identification of text regions on the card Character recognition: Conversion of visual text to digital data Data validation: Verification of extracted information against expected patterns Structured output: Organization of data into standardized formats The advanced OCR technology for payments used by ScanDoc ensures precise data capture from any card type. This technology continuously improves through machine learning, becoming more accurate with each scan processed. [caption id="attachment_2498" align="aligncenter" width="810"] Credit Card Data Extraction[/caption] Key Benefits of ScanDoc’s Bank Card Scanning Solution Speed and Efficiency Among modern payment processing solutions, ScanDoc stands out for its exceptional accuracy and speed. The system can process a card in seconds, compared to the 15-30 seconds typically required for manual entry. This efficiency translates to: Faster checkout experiences for customers Reduced wait times in queues Higher transaction processing capacity More efficient allocation of staff resources Accuracy and Error Reduction Manual data entry inevitably leads to errors, with typical error rates ranging from 0.5% to 3%. These errors can result in failed transactions, customer frustration, and time-consuming corrections. ScanDoc’s bank card scanning solution achieves over 99% accuracy, virtually eliminating these issues. Businesses implementing ScanDoc’s automated card processing report significant reductions in transaction times and error rates. This improvement leads to fewer payment disputes, chargebacks, and customer service issues related to incorrect data entry. Improved Security Security is paramount when handling payment card information. ScanDoc’s secure card scanning meets all regulatory requirements for financial data protection. The system processes card data locally without storing images, reducing the risk of data breaches. Additionally, the elimination of manual entry means fewer people have access to sensitive card information, further improving security. Advanced Credit Card Scanning Technology Behind ScanDoc’s Solution ScanDoc’s credit card scanning technology represents the cutting edge of financial data capture. The system employs sophisticated image recognition capabilities that can: Read embossed and flat-printed card details Process cards with various designs and layouts Handle damaged or worn cards Recognize special characters and formats used in financial information The integration of AI in payment processing allows ScanDoc to continuously improve its recognition accuracy. The AI component learns from each scan, adapting to new card designs and improving its ability to handle challenging scanning conditions. Comprehensive Card Data Extraction with ScanDoc Secure card data extraction is at the core of ScanDoc’s value proposition for financial institutions. The system can extract all visible information from payment cards, including: Credit Card Number: The 15-16 digit PAN is accurately captured and validated using checksum algorithms to ensure correctness. Cardholder Name: The system recognizes and extracts the cardholder’s name, correctly handling various formats and special characters. Expiry Date: Card expiration dates are captured and formatted consistently, regardless of the presentation format on the card. IBAN Scanning Technology for International Payments: For cards that include IBAN information, ScanDoc’s IBAN scanning technology supports international payment processing without manual entry. This feature is particularly valuable for businesses operating in regions where IBAN is commonly used. With ScanDoc’s credit card information scanning, all visible card details are captured in one go, eliminating the need for multiple data entry steps. Integrating ScanDoc with Your Existing Digital Payment Solutions One of ScanDoc’s most valuable features is its open API architecture, which enables seamless integration with existing systems. ScanDoc seamlessly integrates with existing digital payment solutions through its open API architecture, allowing businesses to: Connect with payment gateways Integrate with point-of-sale systems Link to customer relationship management (CRM) software Work with accounting and financial management tools The API is well-documented and designed for developer-friendly implementation, with sample code and integration guides available. This flexibility means businesses can add ScanDoc’s capabilities to their existing workflow without disrupting their current operations. [caption id="attachment_2499" align="aligncenter" width="811"] credit card scan[/caption] Simplify Your Automated Card Processing with ScanDoc Implementing ScanDoc’s solution is straightforward and delivers immediate benefits. The system can be deployed as: A mobile SDK for integration into iOS and Android applications A web-based solution for browser applications A standalone system for specific point-of-sale environments Businesses can choose the implementation that best fits their needs and technical infrastructure. The automated card processing capabilities can be customized to match specific business requirements, including: Custom data validation rules Specific data extraction requirements Branded user interfaces Integration with proprietary systems Conclusion: Elevating Payment Processing with ScanDoc ScanDoc’s bank card scanning solution represents a significant advancement in payment processing technology. By combining cutting-edge OCR, AI capabilities, and seamless integration options, ScanDoc eliminates the inefficiencies and errors associated with manual card data entry. The benefits extend beyond simple time savings to include improved security, improved customer experience, and reduced operational costs. As businesses continue to seek ways to optimize their payment processes, ScanDoc provides a proven solution that addresses multiple pain points simultaneously. For financial institutions, retailers, and service providers looking to simplify their payment operations, ScanDoc offers the ideal combination of speed, accuracy, and integration capabilities. By implementing this technology, businesses can stay competitive in an increasingly digital financial landscape while providing better service to their customers. Ready to experience the benefits of automated card scanning? Try ScanDoc Bank Card Scanning today. Contact ScanDoc today to learn more about implementation options and see a demonstration of the technology in action.

Read more How to Build eIDAS-Compliant Barcode Scanning Solution?

How to Build eIDAS-Compliant Barcode Scanning Solution?

Digital transformation has revolutionized how businesses operate across borders, particularly within the European Union. However, this shift brings significant challenges in verifying identities and ensuring secure electronic transactions. The eIDAS regulation addresses these challenges by establishing a standardized framework for electronic identification and trust services. Despite its importance, many organizations struggle with implementation due to technical complexities and evolving requirements. This article explores what eIDAS is, how organizations can prepare for compliance, and how ScanDoc’s barcode scanning technology plays a crucial role in simplifying implementation through efficient data extraction and solution integration. What is eIDAS? The Foundation of Digital Trust in Europe eIDAS compliance refers to adherence to Regulation (EU) No 910/2014, which came into effect on July 1, 2016. This regulation replaced the earlier eSignature Directive (1999/93/EC) and established a comprehensive framework for electronic identification and trust services across all EU member states. The eIDAS regulation serves a fundamental purpose: to create a predictable regulatory environment for secure electronic interactions between citizens, businesses, and public authorities. Establishing mutual recognition of electronic identification means across borders enables seamless digital transactions throughout the European single market. Key Components of eIDAS The regulation addresses two primary areas: Electronic identification: This component focuses on the system and processes used to verify the identity of individuals or organizations in the digital realm. The regulation defines three assurance levels: Low: Basic identity verification with minimal security requirements Substantial: More rigorous verification with stronger security controls High: The most stringent level requiring sophisticated verification methods Trust services: These are electronic services that create, validate, and preserve various forms of electronic transactions. The regulation recognizes five core trust services: Electronic signatures: Digital expressions of a person’s agreement to document content Electronic seals: Digital equivalents of business stamps that guarantee document origin Electronic timestamps: Elements that link documents to specific points in time Website authentication: Certificates that verify website trustworthiness Electronic registered delivery: Secure channels for document transmission A qualified trust service provider must undergo rigorous certification and regular audits to achieve and maintain this status. These providers appear on national trusted lists, giving them legal recognition throughout the EU. The Evolution to eIDAS 2.0 The digital landscape continues to evolve, prompting the European Commission to propose amendments known as eIDAS 2.0. This update introduces the European Digital Identity Wallet, a tool that enables citizens to store and manage their digital identities and official documents securely. The European Digital Identity Wallet represents a significant advancement in the implementation of electronic identification, enabling citizens to prove their identity and share electronic documents with just a few clicks. Organizations must prepare for these changes as they will impact how digital identity verification is conducted. How to Prepare for eIDAS Compliance Achieving eIDAS compliance requires a systematic approach that addresses both technical and organizational aspects. Here’s a comprehensive guide to preparing your organization: 1. Assess Your Current Digital Identity Infrastructure Begin by evaluating your existing systems and processes for electronic identification and trust services. This assessment should: Identify which digital transactions require eIDAS compliance Evaluate current authentication methods against eIDAS assurance levels Review document verification processes for compliance gaps Assess cryptographic algorithms and key management practices Many organizations discover that their existing document verification processes fall short of eIDAS requirements, particularly regarding cross-border recognition and security controls. 2. Determine Required Assurance Levels Based on your business needs and risk assessment, determine which assurance level is appropriate for different transactions. Consider: The sensitivity of the data being processed Legal requirements for specific industries (banking, healthcare, etc.) Cross-border transaction requirements User experience implications For most business applications involving financial transactions or personal data, the “substantial” level is typically the minimum requirement. 3. Select Appropriate Trust Services Identify which trust services are necessary for your operations: Do you need qualified electronic signatures for legally binding agreements? Are electronic seals required for organizational validation? Do you need qualified timestamps for time-sensitive transactions? Is secure delivery of documents essential to your processes? Each trust service has specific implementation requirements that must be addressed in your compliance strategy. 4. Implement Secure Digital Identity Solutions Secure digital identity implementation requires robust technical solutions that: Support the required assurance levels Implement proper cryptographic controls Ensure data protection and privacy Enable interoperability with other systems This often involves integrating specialized tools like barcode solutions that can securely capture and process identity information from official documents. 5. Partner with Qualified Providers Unless you plan to become a qualified trust service provider yourself, you’ll need to partner with existing qualified providers. Consider: Their certification status and inclusion in trusted lists The specific services they offer Integration capabilities with your systems Support for cross-border operations 6. Prepare for Certification and Audits If you’re implementing trust services that require qualified status, prepare for the certification process: Engage with an accredited Conformity Assessment Body Document your security controls and processes Implement comprehensive audit logging Establish incident response procedures Regular audits (at least every 24 months) are mandatory for maintaining qualified status. 7. Plan for the European Digital Identity Wallet As eIDAS 2.0 approaches implementation, organizations should prepare for integration with the European Digital Identity Wallet: Monitor regulatory developments and technical specifications Plan API integrations for wallet compatibility Design user experiences that leverage wallet capabilities Consider how your verification processes will adapt to this new paradigm How ScanDoc Simplifies eIDAS Implementation Through Barcode Technology ScanDoc’s barcode scanning technology offers a powerful solution for organizations implementing eIDAS-compliant identification processes. By automating data extraction and system integration, ScanDoc addresses key challenges in the compliance journey. Advanced Barcode Solutions for Secure Document Verification Modern barcode solutions play a crucial role in secure document verification. ScanDoc’s technology supports multiple barcode formats (QR, Data Matrix, PDF417) commonly used in identity documents across Europe. This versatility ensures compatibility with various national ID schemes and supports cross-border recognition as required by eIDAS. Several critical functions: Captures barcode data from physical and digital documents Verifies the authenticity of the encoded information Extracts identity attributes securely Processes data according to eIDAS security requirements This automated approach significantly reduces the risk of manual data entry errors while accelerating verification workflows. Seamless Integration with Identity Providers and Trust Services ScanDoc facilitates electronic identification through its advanced integration capabilities. The system connects with: National identity providers across EU member states Qualified trust service providers for signature validation Authentication systems at various assurance levels Existing business applications and workflows This integration capability is essential for organizations implementing digital identity solutions that must work across multiple systems and platforms. Supporting eIDAS Assurance Levels ScanDoc’s architecture supports the implementation of all three eIDAS assurance levels: Low: Basic barcode scanning with standard verification Substantial: Simplified verification with cryptographic validation High: Advanced security controls, including tamper detection Organizations can configure the system based on their specific compliance requirements, ensuring they meet the necessary standards without implementing excessive controls that might impact user experience. Automating Data Extraction and Processing One of ScanDoc’s most valuable features is its ability to extract information from barcodes and inject it directly into applications or systems. This capability: Eliminates manual data entry, reducing errors and processing time Ensures consistent data formatting across systems Maintains data integrity throughout the process Creates audit trails for compliance verification For example, when scanning an identity document with a barcode, ScanDoc can extract personal information, verify its authenticity, and automatically populate registration forms or authentication solutions—all while maintaining eIDAS compliance. Preparing for the European Digital Identity Wallet ScanDoc is designed with future compatibility in mind, particularly regarding the European Digital Identity Wallet. The system: Supports the emerging standards for wallet integration Enables QR code scanning for wallet authentication Maintains compliance with evolving eIDAS 2.0 requirements This forward-looking approach helps organizations prepare for the next generation of digital identity verification while addressing current compliance needs. Benefits of Using ScanDoc for eIDAS Compliance Implementing ScanDoc for eIDAS compliance offers several significant advantages: Simplifyed Security and Compliance Automated verification reduces the risk of human error in identity verification Cryptographic validation ensures document authenticity Secure data handling complies with eIDAS security requirements Comprehensive audit logging supports compliance verification Improved Efficiency and User Experience Reduces verification time from minutes to seconds Eliminates manual data entry and associated errors Provides a consistent experience across different document types Supports both in-person and remote verification scenarios Future-Proof Implementation Compatibility with evolving eIDAS 2.0 requirements Support for the European Digital Identity Wallet Adaptability to new barcode formats and standards Regular updates to maintain compliance with regulatory changes Cost-Effective Compliance Reduces implementation costs compared to custom-built solutions Minimizes ongoing operational expenses through automation Lowers the risk of non-compliance penalties Provides scalability to handle growing transaction volumes Conclusion eIDAS compliance presents both challenges and opportunities for organizations operating in the European digital market. By establishing a standardized framework for electronic identification and trust services, the regulation enables secure cross-border transactions while protecting consumers and businesses. Preparing for eIDAS requires a systematic approach that addresses technical, organizational, and legal aspects of digital identity verification. By implementing appropriate solutions and partnering with qualified providers such as ScanDoc, organizations can achieve compliance while improving their digital processes. ScanDoc’s barcode scanning technology offers a powerful tool for organizations on this journey, automating document verification and data integration while maintaining compliance with eIDAS requirements. As the regulatory landscape evolves with eIDAS 2.0 and the European Digital Identity Wallet, ScanDoc’s forward-looking approach ensures that organizations remain compliant while benefiting from the latest advances in digital identity technology. By investing in the right tools and processes today, organizations can not only achieve eIDAS compliance but also position themselves for success in the increasingly digital European market.

Read more FAQ

FAQ

What is ScanDoc? ScanDoc is an AI-powered identity verification platform that streamlines KYC and AML processes with advanced OCR, facial recognition, and passive liveness detection. What is OCR in identity verification? OCR (Optical Character Recognition) is the technology that automatically reads and extracts text from documents like IDs and passports. ScanDoc uses AI-enhanced OCR to capture names, birthdates, ID numbers, and more with high accuracy. What is the MRZ on an ID or passport? The MRZ (Machine Readable Zone) is the set of lines typically found at the bottom of a passport or ID card. It contains encoded data like document number, nationality, and date of birth for fast, machine-based verification. How accurate is ScanDoc’s OCR technology? ScanDoc’s OCR engine delivers over 99% accuracy, even on worn or low-quality documents. It’s designed for speed and precision, reducing the need for manual corrections during onboarding. How does ScanDoc verify identity? It extracts data from ID documents, matches facial features biometrically, and confirms user presence using liveness detection—all in real time. What documents does ScanDoc support? ScanDoc recognizes over 10,000+ identity documents from more than 200 countries, including passports, national IDs, driver's licenses, and residence permits. How does ScanDoc prevent identity fraud? ScanDoc layers biometric verification with document analysis and liveness detection to stop identity fraud before it reaches your system. Can ScanDoc integrate into my existing app or system? Yes. ScanDoc offers flexible integration through REST APIs, mobile SDKs for iOS/Android, and Docker containers to embed into your onboarding workflow. What is eKYC and how does ScanDoc support it? eKYC is digital identity verification. ScanDoc automates it with online document capture, facial recognition, and fraud detection—no in-person steps required. Which industries benefit from ScanDoc? Fintech, crypto, telecom, banking, insurance, healthcare, travel, and government use ScanDoc for fast, secure digital onboarding. How fast is the verification process? Users can complete verification in under 30 seconds, reducing friction and increasing sign-up conversion rates. Is ScanDoc secure for handling sensitive data? Yes. Data is encrypted at rest and in transit, handled in compliance with privacy regulations, and protected by security-first infrastructure.

Read more